Financial Crimes Enforcement Network

| |

| Agency overview | |

|---|---|

| Formed | April 25, 1990 |

| Headquarters | Vienna, Virginia |

| Annual budget | $114.222 million (2018)[1] |

| Agency executive |

|

| Parent agency | Office of Terrorism and Financial Intelligence |

| Website | www |

The Financial Crimes Enforcement Network (FinCEN) is a bureau within the United States Department of the Treasury that collects and analyzes information about financial transactions to combat domestic and international money laundering, terrorist financing, and other financial crimes.

Mission

[edit]FinCEN's stated mission is "safeguard the financial system from illicit activity, counter money laundering and the financing of terrorism, and promote national security through strategic use of financial authorities and the collection, analysis, and dissemination of financial intelligence."[2] FinCEN serves as the U.S. Financial Intelligence Unit (FIU) and is one of 147 FIUs making up the Egmont Group of Financial Intelligence Units. FinCEN's self-described motto is "follow the money." The website states: "The primary motive of criminals is financial gain, and they leave financial trails as they try to launder the proceeds of crimes or attempt to spend their ill-gotten profits."[3] It is a network bringing people and information together, by coordinating information sharing with law enforcement agencies, regulators and other partners in the financial industry.[3]

History

[edit]FinCEN was established by Treasury Order 105-08 on April 25, 1990.[4] In May 1994, its mission expanded to involve regulatory responsibilities. In October 1994, Treasury's Office of Financial Enforcement merged with FinCEN.[5] On September 26, 2002, after passage of Title III of the PATRIOT Act, Treasury Order 180-01[6] designated FinCEN as an official bureau within the Department of the Treasury.

Since 1995, FinCEN has employed the FinCEN Artificial Intelligence System (FAIS).[7]

In September 2012, FinCEN's information technology called FinCEN Portal and Query System, migrated with 11 years of data into FinCEN Query, a search engine similar to Google. It is a "one stop shop" [sic] accessible via the FinCEN Portal allowing broad searches across more fields than before and returning more results. Since September 2012 FinCEN generates 4 new reports: Suspicious Activity Report (FinCEN SAR), Currency Transaction Report (FinCEN CTR), the Designation of Exempt Person (DOEP) and Registered Money Service Business (RMSB).[8]

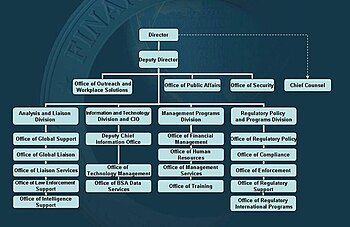

Organization

[edit]

As of November 2013, FinCEN employed approximately 340 people, mostly intelligence professionals with expertise in the financial industry, illicit finance, financial intelligence, the AML/CFT (anti-money laundering / combating the financing of terrorism) regulatory regime, computer technology, and enforcement".[9] The majority of the staff are permanent FinCEN personnel, with about 20 long-term detailees assigned from 13 different regulatory and law enforcement agencies.[8] FinCEN shares information with dozens of intelligence agencies, including the Bureau of Alcohol, Tobacco, and Firearms; the Drug Enforcement Administration; the Federal Bureau of Investigation; the U.S. Secret Service; the Internal Revenue Service; the Customs Service; and the U.S. Postal Inspection Service.[10]

FinCEN directors

[edit]- Brian M. Bruh (1990–1993)

- Stanley E. Morris (1994–1998)

- James F. Sloan (April 1999 – October 2003)

- William J. Fox (December 2003 – February 2006)

- Robert Werner Duemling (March 2006 – December 2006)

- James H. Freis, Jr. (March 2007 – August 2012)

- Jennifer Shasky Calvery (September 2012 – May 2016)

- Jamal El-Hindi (Acting, June 2016 – November 2017)

- Kenneth Blanco (November 2017 – April 2021) [11]

- Michael Mosier (Acting, April 2021 – August 2021) [12]

- Himamauli Das (Acting, August 2021 – ???) [13]

- Andrea Gacki (July 2023 - Present)[14]

314 program

[edit]The 2001 USA PATRIOT Act required the Secretary of the Treasury to create a secure network for the transmission of information to enforce the relevant regulations. FinCEN's regulations under Section 314(a) enable federal law enforcement agencies, through FinCEN, to reach out to more than 45,000 points of contact at more than 27,000 financial institutions to locate accounts and transactions of persons that may be involved in terrorist financing and/or money laundering. A web interface allows the person(s) designated in §314(a)(3)(A) to register and transmit information to FinCEN. The partnership between the financial community and law enforcement allows disparate bits of information to be identified, centralized, and rapidly evaluated.[15]

Hawala

[edit]As early as 2003 FinCEN disseminated information on "informal value transfer systems" (IVTS), including hawala, a network of people receiving money for the purpose of making the funds payable to a third party in another geographic location,... generally taking place outside of the conventional banking system through non-bank financial institutions or other business entities whose primary business activity may not be the transmission of money.[16] On September 1, 2010, FinCEN issued a guidance on IVTS referencing United States v. Banki and hawala.[17]

Virtual currencies

[edit]In July 2011, FinCEN added "other value that substitutes for currency" to its definition of money services businesses in preparation for adapting the respective rule to virtual currencies.[18] On March 18, 2013, FinCEN issued a guidance regarding virtual currencies,[19] according to which, exchangers and administrators, but not users of convertible virtual currency are considered money transmitters, and must comply with rules to prevent money laundering/terrorist financing ("AML/CFT") and other forms of financial crime, by record-keeping, reporting and registering with FinCEN. Jennifer Shasky Calvery, director of FinCEN said, "Virtual currencies are subject to the same rules as other currencies. … Basic money services business rules apply here."[20]

At a November 2013 Senate hearing, Calvery stated, "It is in the best interest of virtual currency providers to comply with these regulations for a number of reasons. First is the idea of corporate responsibility," contrasting Bitcoin's understanding of a peer to peer system bypassing corporate financial institutions. She stated that FinCEN collaborates with the Federal Financial Institutions Examination Council, a congressionally-chartered forum called the "Bank Secrecy Act (BSA) Advisory Group" and BSA Working Group to review and discuss new regulations and guidance, with the FBI-led "Virtual Currency Emerging Threats Working Group" (VCET) formed in early 2012, the FDIC-led "Cyber Fraud Working Group", the Terrorist Financing & Financial Crimes-led "Treasury Cyber Working Group", and with a community of other financial intelligence units.[9] According to the Department of Justice, VCET members represent the FBI, the Drug Enforcement Administration, multiple U.S. Attorney's Offices, and the Criminal Division's Asset Forfeiture and Money Laundering Section and Computer Crime and Intellectual Property Section.[21]

In 2021, amendments to the Bank Secrecy Act and the federal AML/CTF framework officially incorporated the existing FinCEN guidelines on digital assets. The legislation was updated to encompass "value that substitutes for currency," reinforcing FinCEN's authority over digital assets. As a result, exchanges dealing in these assets were required to register with FinCEN and adhere to specific reporting and recordkeeping obligations for transactions involving certain types of digital assets. [22] For the year 2021, FinCEN received 1,137,451 Suspicious Activity Reports (SARs), which include both traditional financial institutions and cryptocurrency trading entities. Within this category, there were reports of 7,914 suspicious cyber events and 284,989 potential money laundering activities. FinCEN utilizes a dedicated team of analysts to examine these SARs, aiming to detect possible money laundering incidents. [23]

Beneficial Ownership Information Reports

[edit]FinCEN is the regulatory agency tasked with overseeing the Beneficial Ownership Information Reporting (BOIR) system in the U.S. This responsibility was established under the Corporate Transparency Act (CTA), which mandates that certain business entities must disclose information about their beneficial owners to FinCEN. CTA aims to enhance transparency and combat financial crimes by preventing the use of anonymous shell companies for illicit purposes.[24] On December 3, 2024, the U.S. District Court for the Eastern District of Texas issued a preliminary injunction against nationwide implementation of the CTA, citing concerns about its constitutionality and impact on small businesses.[25][26][27] Treasury filed a notice of appeal on December 5, 2024.[28]

FinCEN administers the BOIR system to collect and maintain accurate records of beneficial ownership information. This information includes details such as the names, addresses, dates of birth, and identification numbers of individuals who ultimately own or control companies. By centralizing this data, FinCEN supports law enforcement efforts to investigate and prosecute financial crimes, ensuring greater accountability and integrity within the corporate sector.[29]

Controversies

[edit]In 2009, the GAO found "opportunities" to improve "interagency and state examination coordination", noting that the federal banking regulators issued an interagency examination manual, that SEC, CFTC, and their respective self-regulatory organizations developed Bank Secrecy Act (BSA) examination modules, and that FinCEN and IRS examining nonbank financial institutions issued an examination manual for money services businesses. Therefore multiple regulators examine compliance of the BSA across industries and for some larger holding companies even within the same institution. Regulators need to promote greater consistency, coordination and information-sharing, reduce unnecessary regulatory burden, and find concerns across industries.[30] FinCEN estimated that it would have data access agreements with 80 percent of state agencies that conduct BSA examinations after 2012.[30]

Since FinCEN's inception in 1990, the Electronic Frontier Foundation in San Francisco has debated its benefits compared to its threat to privacy.[31] FinCEN does not disclose how many Suspicious Activity Reports result in investigations, indictments or convictions, and no studies exist to tally how many reports are filed on innocent people. FinCEN and money laundering laws have been criticized for being expensive and relatively ineffective while violating Fourth Amendment rights, as an investigator may use FinCEN's database to investigate people instead of crimes.[32]

It has also been alleged that FinCEN's regulations against structuring are enforced unfairly and arbitrarily; for example, it was reported in 2012 that small businesses selling at farmers' markets have been targeted, while politically connected people like Eliot Spitzer were not prosecuted.[33] Spitzer's reasons for structuring were described as "innocent".[34]

In February 2019, it was reported that Mary Daly, the oldest daughter of United States Attorney General William Barr, is to leave her position at the United States Deputy Attorney General's office for a FinCEN position.[35][36][37]

In September 2020, findings based on a set of 2,657 documents including 2121 suspicious activity reports (SARs) leaked from FinCEN were published as the FinCEN Files.[38][39] The leaked documents showed that although both FinCEN and the banks that filed SARs knew about billions of dollars in dirty money being moved through the banks, both did very little to prevent the transactions.[38]

In popular culture

[edit]The 2016 film The Accountant features a FinCEN investigation into the title character.[40]

In the first episode of the 2017 Netflix show Ozark, FinCEN is mentioned as one of the agencies (along with the DEA, ATF, and FBI) active in monitoring cartel activity in Chicago.

See also

[edit]- Casino regulations under the Bank Secrecy Act

- Currency transaction report

- FINTRAC – Canada's equivalent to FinCEN

- Timeline of post-election transition following Russian interference in the 2016 United States elections

- Timeline of investigations into Trump and Russia (January–June 2017)

- Timeline of investigations into Trump and Russia (July–December 2018)

- Title 31 of the Code of Federal Regulations

- List of financial regulatory authorities by jurisdiction

References

[edit]- ^ "FY 2019 Budget in Brief: Financial Crimes and Enforcement Network" (PDF). United States Department of the Treasury. Retrieved March 18, 2021.

- ^ "FinCEN - Mission". Financial Crimes Enforcement Network. Archived from the original on October 7, 2024. Retrieved November 1, 2024.

- ^ a b "FinCEN - What we do". FinCEN website. FinCEN. Archived from the original on 14 November 2016. Retrieved 13 November 2016.

- ^ "Department of The Treasury Order 105-08" (PDF). Financial Crimes Enforcement Network. Archived from the original (PDF) on September 29, 2024. Retrieved November 1, 2024.

- ^ "History of the Financial Crimes Enforcement Network" (PDF). Financial Crimes Enforcement Network. Archived from the original (PDF) on October 2, 2024. Retrieved November 1, 2024.

- ^ "TREASURY ORDER 180-01". U.S. Dept Treasury. March 24, 2003. Archived from the original on 6 March 2014. Retrieved 6 March 2014.

- ^ Goldberg, H. G.; Senator, T. E. (1998). "The FinCEN AI System: Finding Financial Crimes in a Large Database of Cash Transactions". Agent Technology. pp. 283–302. doi:10.1007/978-3-662-03678-5_15. ISBN 978-3-642-08344-0.

- ^ a b "FinCEN - FinCEN's IT Modernization Efforts FAQs". FinCEN website. FinCEN. Archived from the original on 17 February 2014. Retrieved 6 March 2014.

- ^ a b Shasky Calvery, Jennifer (November 18, 2013). "Statement of Jennifer Shasky Calvery, Director Financial Crimes Enforcement Network US Department of the Treasury Before the US Senate Committee on Homeland Security and Government Affairs". Financial Crimes Enforcement Network. Archived from the original on 26 March 2014. Retrieved 6 March 2014.

- ^ "FinCEN Launches "FinCEN Exchange" to Enhance Public-Private Information Sharing". Financial Crimes Enforcement Network. December 4, 2017. Retrieved October 31, 2024.

- ^ "Treasury Announces Ken Blanco as FinCEN Director". Archived from the original on 2019-07-15. Retrieved 2019-07-15.

- ^ "FinCEN Names New Acting Director, Begins Search for Permanent Chief" The Wall Street Journal, August 3, 2021. Retrieved June 1, 2023.

- ^ "FinCEN Announces New Acting Director" Financial Crimes Enforcement Network, August 3, 2021. Retrieved October 18, 2022.

- ^ "The Treasury Department Announces Andrea Gacki as the New Director of FinCEN". United States Department of the Treasury Financial Crimes Enforcement Network | FinCEN.gov. 13 July 2023. Retrieved 28 August 2023.

- ^ "Appendix A – Financial Crimes enforcement network programs" (PDF). FinCEN. Archived from the original (PDF) on 2 March 2013. Retrieved 23 August 2016.

- ^ "Informal Value Transfer Systems" (PDF). Financial Crimes Enforcement Network FinCEN Advisory. United States Department of the Treasury. March 2003. Archived from the original (PDF) on 30 June 2014. Retrieved 6 March 2014.

- ^ "Informal Value Transfer Systems". Financial Crimes Enforcement Network. September 1, 2010. Archived from the original on September 5, 2010.

- ^ Financial Crimes Enforcement Network (2011-07-21). "Financial Crimes Enforcement Network". Bank Secrecy Act Regulations; Definitions and Other Regulations Relating to Money Services Businesses. Federal Register. p. 76 FR 43585. Archived from the original on 2020-09-20. Retrieved 6 March 2014.

31 C.F.R. § 1010.100(ff)(5)(i)(A)

- ^ "FIN-2013-G001: Application of FinCEN's Regulations to Persons Administering, Exchanging, or Using Virtual Currencies". Financial Crimes Enforcement Network. 18 March 2013. p. 6. Archived from the original on 19 March 2013. Retrieved 4 March 2014.

- ^ Berson, Susan A. (2013). "Some basic rules for using 'bitcoin' as virtual money". American Bar Association. Archived from the original on 29 October 2013. Retrieved 10 September 2013.

- ^ "Acting Assistant Attorney General Mythili Raman Testifies". Senate Committee on Homeland Security and Governmental Affairs. Washington, D.C.: justice.gov. November 18, 2013. Archived from the original on 24 February 2014. Retrieved 6 March 2014.

- ^ Hossain, Mohammad Belayet (2023-01-01). "Acquiring an awareness of the latest regulatory developments concerning digital assets and anti-money laundering". Journal of Money Laundering Control. 26 (6): 1261–1268. doi:10.1108/JMLC-10-2022-0147. ISSN 1368-5201.

- ^ Wang, Hsiao-Ming; Hsieh, Ming-Li (2024-03-01). "Cryptocurrency is new vogue: a reflection on money laundering prevention". Security Journal. 37 (1): 25–46. doi:10.1057/s41284-023-00366-5. ISSN 1743-4645.

- ^ "U.S. Beneficial Ownership Information Registry Now Accepting Reports". U.S. Department of the Treasury. 2024-09-20. Retrieved 2024-10-04.

- ^ JD, Matthew F. Erskine. "Court Blocks Corporate Transparency Act — A Win For Federalism? Updated". Forbes. Retrieved 2024-12-07.

- ^ Woolley, John (December 6, 2024). "US Appeals Order Halting Corporate Transparency Act Disclosures". Bloomberg Law. Retrieved December 7, 2024.

- ^ Erb, Kelly Phillips. "FinCEN Says Corporate Transparency Act (CTA) Reports Are Voluntary Following Court Decision". Forbes. Retrieved 2024-12-08.

- ^ Tokar, Dylan (2024-12-06). "Treasury Appeals Court Ruling Blocking Corporate Ownership Registry Drive". Wall Street Journal. ISSN 0099-9660. Retrieved 2024-12-12.

- ^ "The Corporate Transparency Act – Preparing for the Federal Database of Beneficial Ownership Information". American Bar Association. April 16, 2021. Retrieved October 4, 2024.

- ^ a b "Bank Secrecy Act: Federal Agencies Should Take Action to Further Improve Coordination and Information-Sharing Efforts". Gao-09-227 (GAO-09-227). GAO.gov. Feb 12, 2009. Archived from the original on 7 March 2014. Retrieved 6 March 2014.

- ^ Bercu, Stephen (December 1991). "FinCEN: Big Brother After All?". EEF.org. Archived from the original on 2016-03-03. Retrieved 2014-03-06.

- ^ Julie Wakefield (October 1, 2000). "Following the Money". Government Executive. Archived from the original on 7 March 2014. Retrieved 6 March 2014.

- ^ Walter Olson (2012-04-20). ""Structuring": who can get away with it, and who can't". Overlawyered. Archived from the original on 2013-12-02. Retrieved 2013-11-30.

- ^ David Johnston; Stephen Labaton (March 12, 2008). "The Reports That Drew Federal Eyes to Spitzer". The New York Times. Archived from the original on January 5, 2018. Retrieved August 27, 2017.

- ^ Bess Levin (February 14, 2019). "William Barr's Son-in-Law Just Landed a Job Advising Trump on "Legal Issues; Tyler McGaughey's work will "intersect" with the Russia investigation". VanityFair.com. Archived from the original on 27 March 2019. Retrieved 20 February 2019.

- ^ David Shortell; Laura Jarrett; Pamela Brown (February 13, 2019). "Daughter and son-in-law of AG nominee leaving the Justice Department". CNN.com. Archived from the original on 21 February 2019. Retrieved 20 February 2019.

- ^ "Attorney General Nominee William Barr's Son-in-Law to Join White House Counsel's Office: Report". TheDailyBeast.com. February 13, 2019. Archived from the original on 15 February 2019. Retrieved 20 February 2019.

- ^ a b "Secret Documents Show How Criminals Use Big-Name Banks To Finance Terror And Death, And The Government Doesn't Stop It". Buzzfeed News. 2020-09-20. Retrieved 2020-09-20.

- ^ "Global banks defy U.S. crackdowns by serving oligarchs, criminals and terrorists". International Consortium of Investigative Journalists. 2020-09-20. Retrieved 2020-09-20.

- ^ Wells, Tish (October 15, 2016). "Film Review: The Accountant (2016)". Archived from the original on November 17, 2016. Retrieved November 16, 2016.

External links

[edit]- 1990 establishments in Washington, D.C.

- Federal law enforcement agencies of the United States

- Anti-money laundering organizations

- Financial regulatory authorities of the United States

- Tax evasion in the United States

- Counterterrorism in the United States

- United States Department of the Treasury

- Vienna, Virginia

- Banking crimes

- Government by algorithm

- United States intelligence agencies